FATF Privacy Coins: What You Need to Know About Regulation and Crypto Anonymity

When you hear FATF privacy coins, cryptocurrencies designed to obscure transaction details to protect user privacy, often targeted by global financial regulators. Also known as privacy-focused tokens, they include coins like Monero, Zcash, and Dash—built to hide sender, receiver, and amount. But since 2019, the Financial Action Task Force (FATF) has labeled them as high-risk, pushing exchanges to block or restrict them entirely. This isn’t about stopping privacy—it’s about stopping money laundering, terrorist financing, and scam recovery schemes that hide behind anonymity.

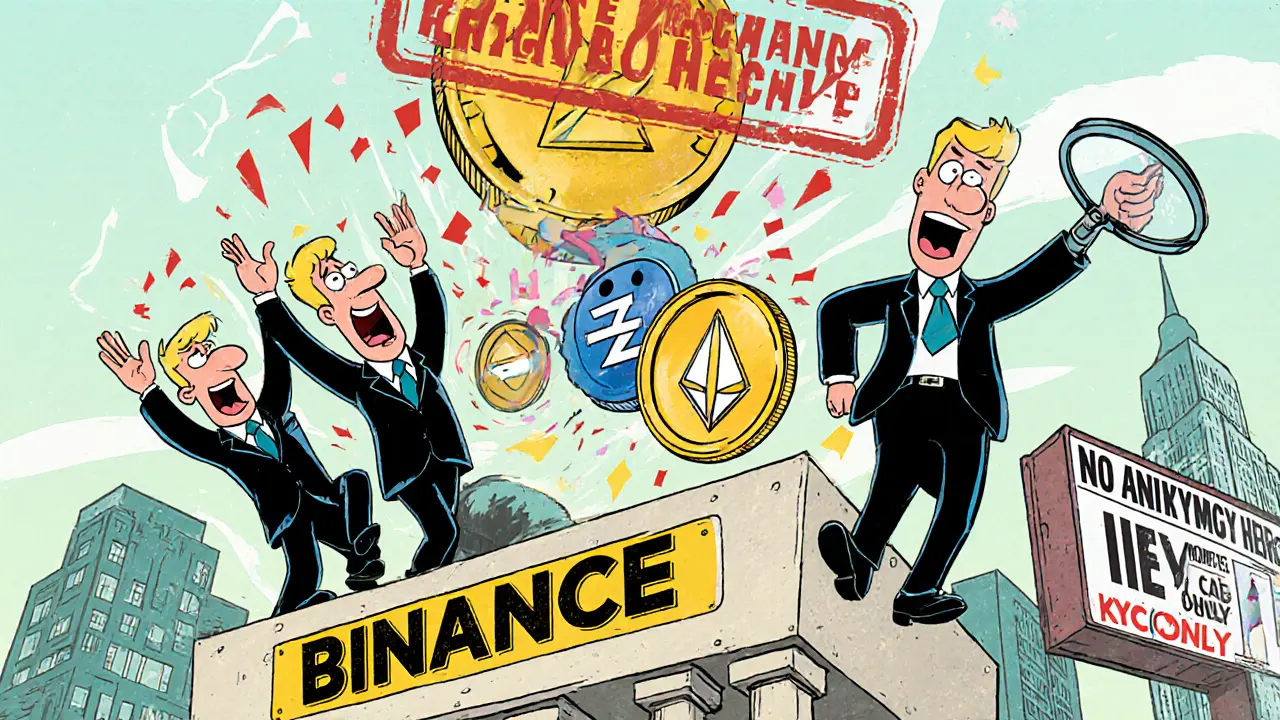

The FATF travel rule, a global standard requiring crypto exchanges to share user identity data for transactions over $1,000. Also known as VASP rule, it forces platforms to collect and pass along KYC info between parties. That’s a direct conflict with how privacy coins work. If you send Monero, the network refuses to reveal who sent it or where it went. So exchanges either shut down privacy coin trading or risk fines from regulators. That’s why you see fewer listings for these coins on major platforms today. Even Suspicious Activity Reporting, the process where crypto platforms flag unusual transactions to authorities like FinCEN. Also known as crypto SAR, it’s now routinely triggered by privacy coin transfers. In 2025, over 70% of SARs involving crypto include privacy coins—even when no crime occurred.

Some projects are trying to adapt. VoltSwap, for example, doesn’t hide transactions but fights front-running bots—offering privacy from manipulation, not from regulators. Meanwhile, Bitcoin’s Liquid Network uses confidential transactions to shield amounts while staying compliant. These aren’t privacy coins in the old sense—they’re privacy within regulation. The real shift isn’t about killing anonymity. It’s about forcing crypto to choose: be fully open or be fully restricted. If you still want privacy, you’ll need to understand the tools that work inside the rules, not outside them.

Below, you’ll find real reviews and breakdowns of platforms and tokens caught in this crossfire—from exchanges that dropped privacy coins to scams pretending to offer them. No fluff. Just what’s happening, who’s affected, and how to stay safe when the rules keep changing.

Privacy coins like Monero and Zcash are being removed from major crypto exchanges due to global regulatory pressure. Learn why this is happening, how it affects users, and what the future holds for financial privacy in crypto.

View More