Ecuador Cryptocurrency Rules: What You Need to Know in 2025

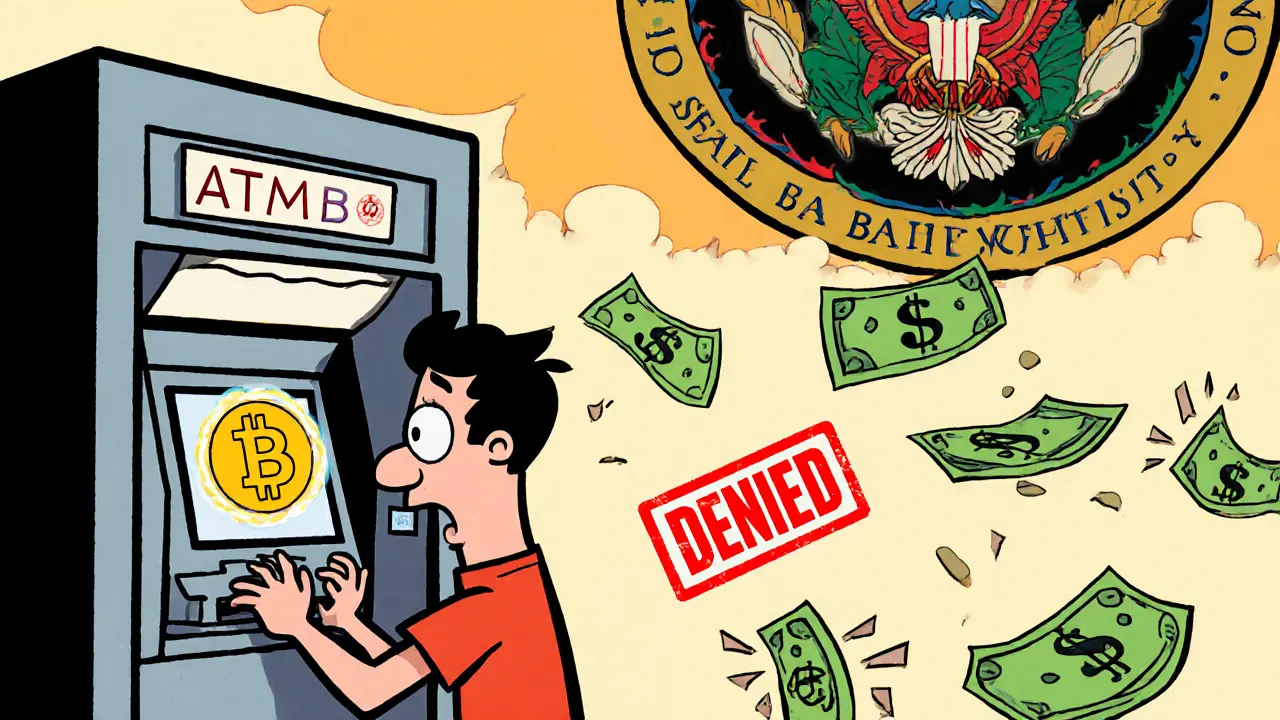

When it comes to Ecuador cryptocurrency rules, the legal status of digital assets in Ecuador remains ambiguous and inconsistently enforced. Also known as Ecuador crypto regulation, this framework doesn’t ban crypto outright—but it doesn’t recognize it as legal tender either. The government has never passed a formal law on cryptocurrency, leaving users in a gray zone where trading is common but unprotected. Unlike countries that clearly license exchanges or tax holdings, Ecuador’s central bank has issued warnings but no concrete guidelines. That means you can buy Bitcoin on peer-to-peer platforms, but you have zero legal recourse if a platform vanishes or your funds get frozen.

This ambiguity affects everything from taxes to banking. Crypto taxation Ecuador, is not formally defined. There’s no official form to declare crypto gains, and no agency audits individual wallets. But if you convert crypto to USD or euros and deposit it into a bank, the transaction could trigger scrutiny under anti-money laundering rules. Meanwhile, crypto laws Ecuador, are shaped more by silence than policy. Banks won’t process crypto-related payments, and most local businesses avoid accepting digital coins. Yet, informal crypto trading thrives through WhatsApp groups, Telegram channels, and cash trades in Quito and Guayaquil.

The lack of regulation hasn’t stopped people from using crypto. Many Ecuadorians turned to Bitcoin during the 2020 peso devaluation, using it to send money abroad or protect savings from inflation. But without clear rules, scams run rampant. Fake exchanges like LocalTrade and unverified airdrops target users who assume crypto is safe because it’s popular. The government’s silence isn’t permission—it’s neglect. And in a space where trust is everything, that’s dangerous.

What you’ll find below are real reviews and breakdowns of platforms and tokens that Ecuadorians are actually using—or avoiding. From unregulated exchanges with fake volume to dead tokens with zero supply, these posts cut through the noise. You won’t find fluff here. Just facts about what’s risky, what’s dead, and what might still work if you’re careful. If you’re trading crypto in Ecuador, you need to know the risks before you click ‘send’.

Ecuador bans banks from processing crypto transactions to protect its dollarized economy. Users rely on peer-to-peer trading and stablecoins, but face account freezes, high fees, and no legal protections. The ban remains strict despite growing demand and a proposed licensing bill.

View More