Ecuador Crypto Ban: What Really Happened and How It Affects Traders

When Ecuador crypto ban, a 2018 government decision to prohibit all cryptocurrency transactions under the Organic Monetary and Financial Code. Also known as Ecuador’s crypto prohibition, it was meant to protect the national currency and prevent financial instability. But the rule never truly stuck. While the government claimed it was cracking down on unregulated digital assets, ordinary people kept using Bitcoin and other coins—through peer-to-peer apps, WhatsApp groups, and informal networks. The ban was more of a symbolic gesture than a practical one.

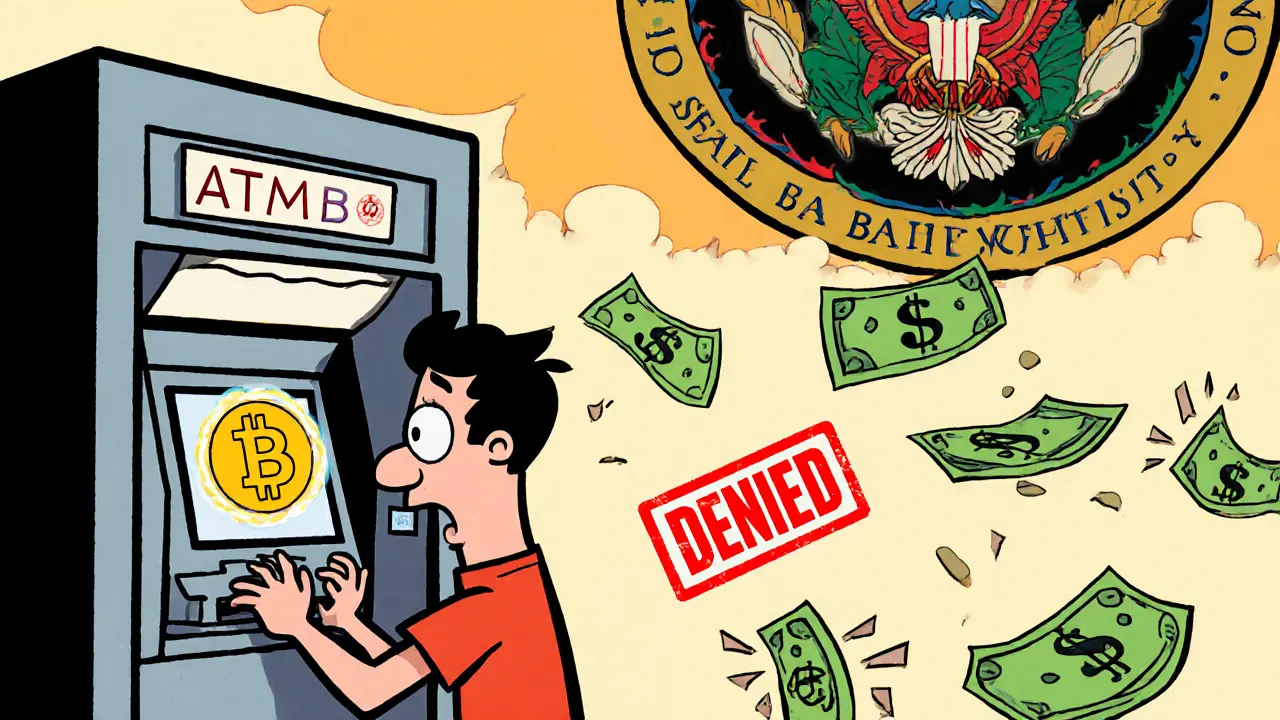

What made the Ecuador crypto ban so ineffective? For one, the country already had high inflation and low trust in banks. People turned to crypto not because it was trendy, but because it was safer than keeping cash in local banks. Even after the ban, crypto ATMs popped up in Quito and Guayaquil. Local traders used cryptocurrency regulation Ecuador loopholes by trading through foreign exchanges and withdrawing cash via P2P platforms like LocalBitcoins. Meanwhile, the Central Bank never had the resources—or the will—to track down thousands of small-time users. The crypto legality Ecuador status stayed murky: technically illegal, but widely ignored.

Today, the ban still exists on paper, but no one enforces it. The government hasn’t prosecuted a single person for owning Bitcoin. Instead, they’ve quietly shifted focus to studying blockchain tech for potential central bank digital currency (CBDC) pilots. Meanwhile, traders in Ecuador still rely on crypto to send remittances, protect savings, and buy goods from international sellers. The crypto trading Ecuador scene thrives in the shadows, supported by a growing network of local crypto meetups and Telegram groups. And while neighboring countries like Argentina and Colombia moved toward regulated frameworks, Ecuador remains stuck in the past—banning what it can’t control.

If you’re in Ecuador and using crypto, you’re not breaking the law in any real sense. You’re just using a tool that works better than the system around it. The real story isn’t about legality—it’s about survival. And that’s why the posts below dig into what actually happened: the scams that filled the vacuum, the exchanges that slipped through the cracks, and how users adapted when the government looked away. You’ll find real cases of people who traded through unregulated platforms, got burned by fake exchanges, or found hidden opportunities in the chaos. This isn’t about policy. It’s about what people did when the rules didn’t match reality.

Ecuador bans banks from processing crypto transactions to protect its dollarized economy. Users rely on peer-to-peer trading and stablecoins, but face account freezes, high fees, and no legal protections. The ban remains strict despite growing demand and a proposed licensing bill.

View More