Cryptocurrency Exchange License: What You Need to Know About Regulation and Safety

When you hear cryptocurrency exchange license, a legal permit issued by a government authority allowing a platform to operate as a crypto trading service under strict oversight. Also known as crypto operating license, it’s the only thing that separates a platform that plays by the rules from one that could vanish with your money tomorrow. Most crypto exchanges you see online don’t have one. Not because they’re too small, but because getting licensed costs millions, takes years, and forces them to reveal everything — who owns them, where the money goes, and how they protect users.

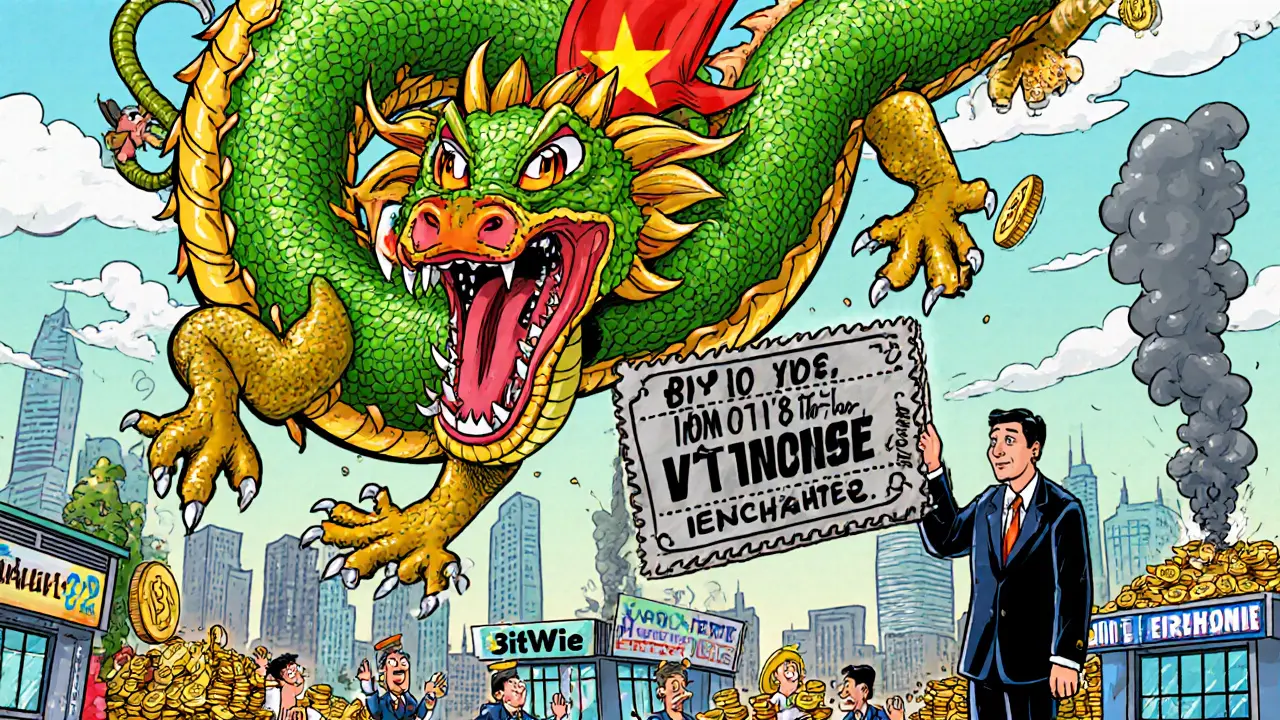

That’s why you see so many sites like LocalTrade or Decoin with no team, no audits, and no traceable address. They don’t need a license — they’re not trying to last. Meanwhile, places like the State Bank of Vietnam, the central banking authority that enforces strict crypto rules in Vietnam, including requiring a $379 million capital reserve for any licensed exchange or the Capital Markets Board Turkey, the Turkish regulator that demands multi-million-dollar licenses and bans crypto payments entirely are forcing exchanges to prove they’re real. These aren’t suggestions — they’re laws with jail time and fines attached. And when a country like the U.S. passes the Investment and Securities Act 2025, the first federal law that clearly defines which crypto assets are securities, commodities, or stablecoins, and who can trade them legally, it changes everything. Suddenly, unlicensed platforms aren’t just shady — they’re illegal.

But here’s the catch: even licensed exchanges still require KYC crypto exchanges, the process of verifying your identity before letting you trade, which helps prevent money laundering and fraud and follow AML crypto, anti-money laundering rules that force platforms to report suspicious activity to financial authorities. That’s not just bureaucracy — it’s your protection. If a platform skips KYC or claims it’s "privacy-first," that’s a red flag. Real regulation doesn’t mean less freedom. It means less risk. The crypto world is full of dead projects, fake airdrops, and zero-supply tokens. But if you’re looking to trade safely, you need to know who’s been vetted — and who’s just pretending.

Below, you’ll find real reviews of platforms that either got licensed, got shut down, or never even tried. You’ll see how rules in Vietnam, Turkey, and the U.S. are shaping what’s safe to use. You’ll learn why some exchanges disappear overnight — and how to spot the ones that are built to last. No fluff. No hype. Just what matters when your money’s on the line.

Vietnam's new crypto framework, Directive 05/CT-TTg, requires exchanges to hold $379 million in capital and bans fiat-backed stablecoins. It's the strictest rule in Southeast Asia-and it's forcing a massive industry shakeup.

View More