Crypto Tax UAE: What You Need to Know About Crypto Taxes in the United Arab Emirates

When it comes to crypto tax UAE, the United Arab Emirates has one of the most straightforward crypto tax systems in the world. Also known as UAE cryptocurrency taxation, it’s a place where you don’t pay capital gains tax, income tax, or VAT on crypto transactions—making it a hotspot for traders and investors. But don’t confuse "no tax" with "no rules." The absence of taxes doesn’t mean you can ignore reporting, compliance, or local financial laws.

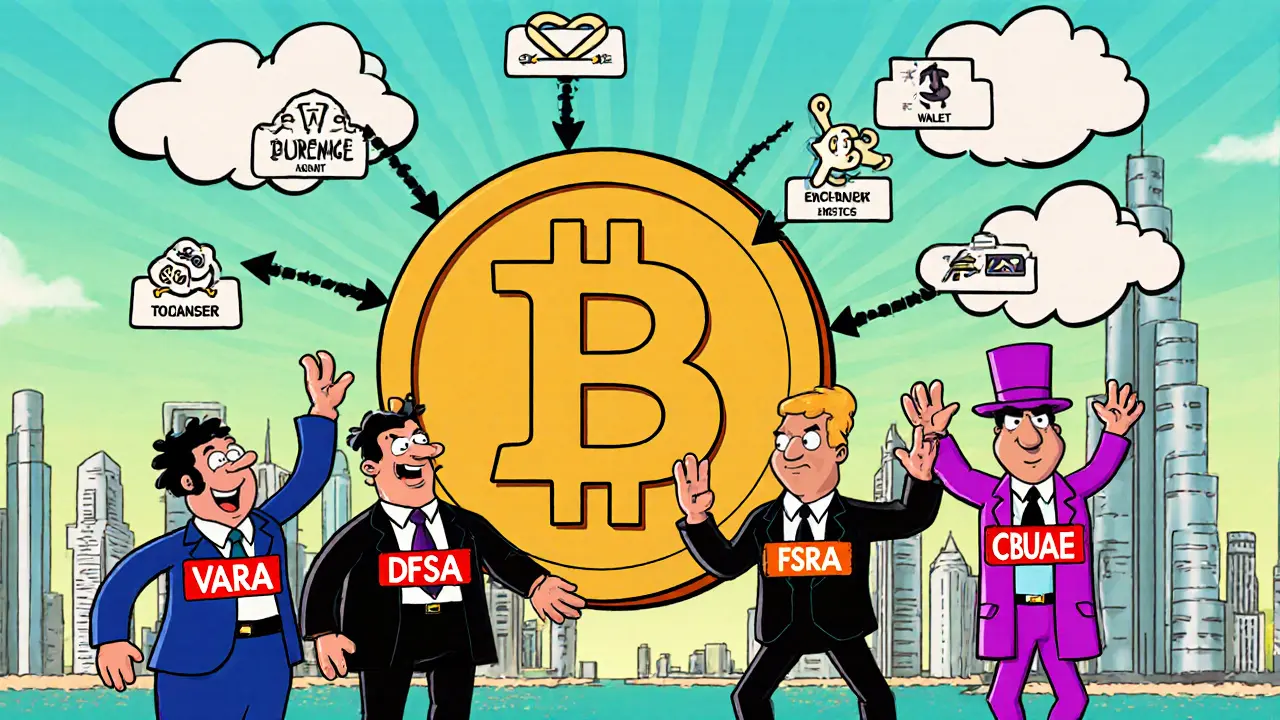

The UAE crypto regulations, managed by the Virtual Assets Regulatory Authority (VARA) and the Central Bank, are strict on licensing, AML, and KYC. If you’re running a business that trades or exchanges crypto, you need a license. If you’re a private individual holding Bitcoin or Ethereum? You’re not taxed—but you still need to keep records. Why? Because if you later move to a country that taxes crypto (like the U.S. or UK), the UAE’s clean records become your proof of non-taxable status. Without them, you could end up paying taxes twice—or worse, flagged for fraud.

What about crypto income tax, the kind you’d pay if you earn crypto from mining, staking, or airdrops? In the UAE, the government doesn’t classify these as taxable income for individuals. But if you’re employed and paid in crypto, your employer might still need to report it internally for payroll compliance. And if you’re a freelancer earning crypto from international clients? You’re not taxed in the UAE—but your client’s country might be watching. That’s why smart users track every transaction: wallet addresses, dates, values in AED, and purpose. A single spreadsheet can save you years of headaches.

There’s no official crypto wealth tax in the UAE, unlike Switzerland or other countries that treat crypto like property. But that doesn’t mean you can ignore it. Banks in the UAE now ask for source of funds on large deposits. If you deposit $50,000 in ETH and can’t explain where it came from, you’ll get questioned. It’s not a tax law—it’s an anti-money laundering rule. And in a country that’s serious about financial reputation, that’s just as dangerous.

What you’ll find in the posts below isn’t a list of tax forms or IRS-style guides. It’s real-world insight from people who’ve navigated the gray areas. You’ll see how one trader avoided a $20,000 tax bill by timing a move out of the UAE. How another got flagged by a bank after an airdrop from a project that vanished overnight. How a miner in Dubai kept records that later helped them prove their crypto wasn’t linked to a scam. These aren’t theoretical scenarios. They’re the kind of stories that matter when your wallet’s on the line.

The UAE offers one of the world’s clearest crypto frameworks for Bitcoin and altcoins. Learn how licensing, tax rules, and regulations work in 2025-and why businesses are moving here in droves.

View More