Crypto Regulatory Crackdown: What It Means for Exchanges, Traders, and Your Wallet

When you hear crypto regulatory crackdown, a coordinated effort by governments to enforce rules on cryptocurrency trading, exchanges, and user identification. Also known as crypto compliance wave, it’s not just paperwork—it’s changing where you can trade, what you need to prove you’re who you say you are, and whether your favorite platform even still exists.

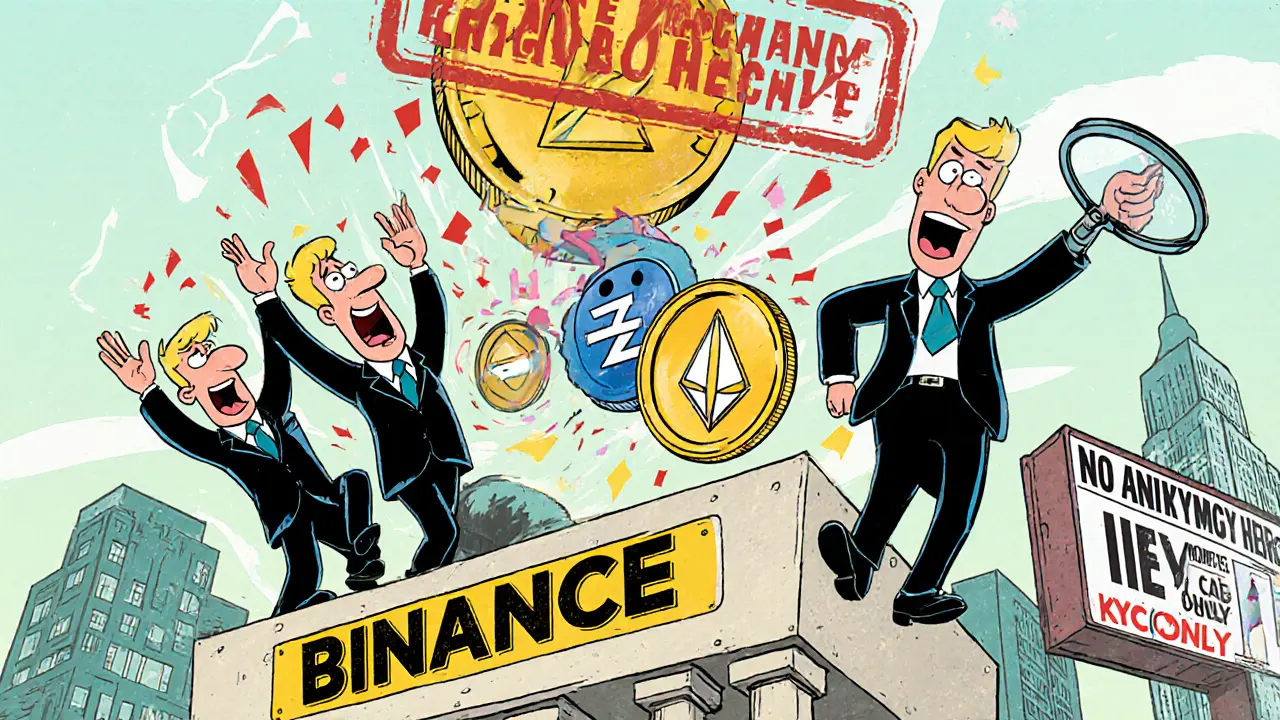

This crackdown isn’t random. It’s a direct response to scams, money laundering, and platforms like LocalTrade and Decoin that operate with zero transparency. Governments are now forcing exchanges to get licenses, report suspicious activity, and verify users through KYC crypto exchanges, platforms that require users to submit government-issued ID and proof of address before trading. Also known as identity verification for crypto, this step is now mandatory in over 80 countries, including the U.S., Turkey, and Vietnam. If you’ve ever wondered why your exchange asked for a selfie with your passport, that’s this crackdown in action.

It’s not just about identity. The AML crypto, anti-money laundering rules that track how crypto moves between wallets and exchanges. Also known as crypto financial surveillance, these systems flag unusual transfers—like sudden large deposits from unverified accounts or rapid movement between high-risk platforms. That’s why platforms like AdEx Network and Metahero now have strict rules around airdrops: if they can’t prove who’s receiving tokens, they risk being shut down. Even decentralized exchanges like VoltSwap and Alien Base are adapting—because regulators don’t care if you’re on a DEX or a centralized platform. If you’re moving value, you’re in scope.

Some countries are going further. Vietnam’s Directive 05/CT-TTg, a strict national framework requiring crypto exchanges to hold over $379 million in capital and banning all fiat-backed stablecoins. Also known as Vietnam crypto law 2025, it’s one of the toughest in Asia—and no exchange has even applied for a license yet. Meanwhile, the U.S. passed the Investment and Securities Act 2025, the first federal law to classify crypto assets into three clear categories: securities, commodities, and stablecoins. Also known as CLARITY Act, it ended years of SEC confusion and finally gave institutions a roadmap to enter the market. Bitcoin? Now a commodity. Stablecoins? Tightly controlled. And platforms that ignore these rules? They disappear overnight.

And it’s not just about big players. If you’re holding tokens like MARGA or CVTX with zero supply or no team, regulators don’t care if you bought them for fun—they see them as unregistered securities. Even NFT royalties and AI DeFi assistants like Hey Anon (ANON) are under scrutiny because they involve value transfer without clear legal standing. The message is clear: if it moves value, it’s regulated.

What you’ll find below are real reviews of platforms caught in this wave—some banned, some compliant, some outright scams. You’ll see how countries like Nepal and Turkey are enforcing bans with jail time, how Switzerland taxes crypto as wealth (not gains), and why the only safe way to trade now is through platforms that play by the rules. This isn’t about fear. It’s about survival. And knowing the rules isn’t optional anymore—it’s your first line of defense.

Privacy coins like Monero and Zcash are being removed from major crypto exchanges due to global regulatory pressure. Learn why this is happening, how it affects users, and what the future holds for financial privacy in crypto.

View More