Crypto in Ecuador: What You Need to Know About Trading, Regulations, and Risks

When people talk about crypto in Ecuador, the use of digital currencies like Bitcoin and Ethereum by individuals and businesses in Ecuador. Also known as digital currency adoption in Ecuador, it’s a mix of grassroots innovation and regulatory uncertainty. Unlike countries with clear crypto laws, Ecuador has no official stance—no ban, no license system, no tax rules. That doesn’t mean it’s safe. It just means you’re on your own.

Most Ecuadorians who trade crypto use peer-to-peer platforms like LocalTrade or Paxful, not regulated exchanges. That’s because local banks rarely support crypto transactions, and no major exchange has a legal presence there. But here’s the catch: many of these P2P platforms are unregulated, have fake volume, or are outright scams. One platform, LocalTrade, is linked to recovery fraud schemes and has zero transparency. If you’re trading crypto in Ecuador, you’re not just betting on price—you’re betting on trust.

People in cities like Quito and Guayaquil are using crypto to protect savings from inflation and send money abroad cheaply. But without KYC requirements enforced by local law, it’s easy for bad actors to exploit the gap. You’ll see ads for fake airdrops, phantom tokens like MARGA with zero supply, and fake IDO launches like HappyFans that vanished overnight. These aren’t just bad projects—they’re designed to target users who don’t know how to spot red flags.

There’s no official guidance from the Central Bank of Ecuador on crypto. No one’s telling you what to declare, how to report gains, or which exchanges are legal. That’s why users rely on community knowledge—forums, Telegram groups, and word of mouth. But that’s also why so many get burned. The same tools that help you trade—wallets, bridges, wrapped tokens like WBTC—are also used by scammers to launder funds or trick you into sending crypto to fake addresses.

And while other countries like Vietnam and Turkey are rolling out strict crypto rules, Ecuador’s silence is its own kind of risk. You can’t rely on government protection. You can’t assume a platform is safe just because it’s popular. You have to verify everything: team, audits, trading volume, user reviews. If it’s too good to be true—like a free MARGA coin or a guaranteed airdrop from Metahero—it’s a trap.

What you’ll find below isn’t a list of places to buy crypto in Ecuador. It’s a list of what to avoid, what’s real, and how to protect yourself in a market where the rules are written by users, not regulators. From fake exchanges to dead tokens to airdrop scams, every post here is a warning sign you need to see before you click.

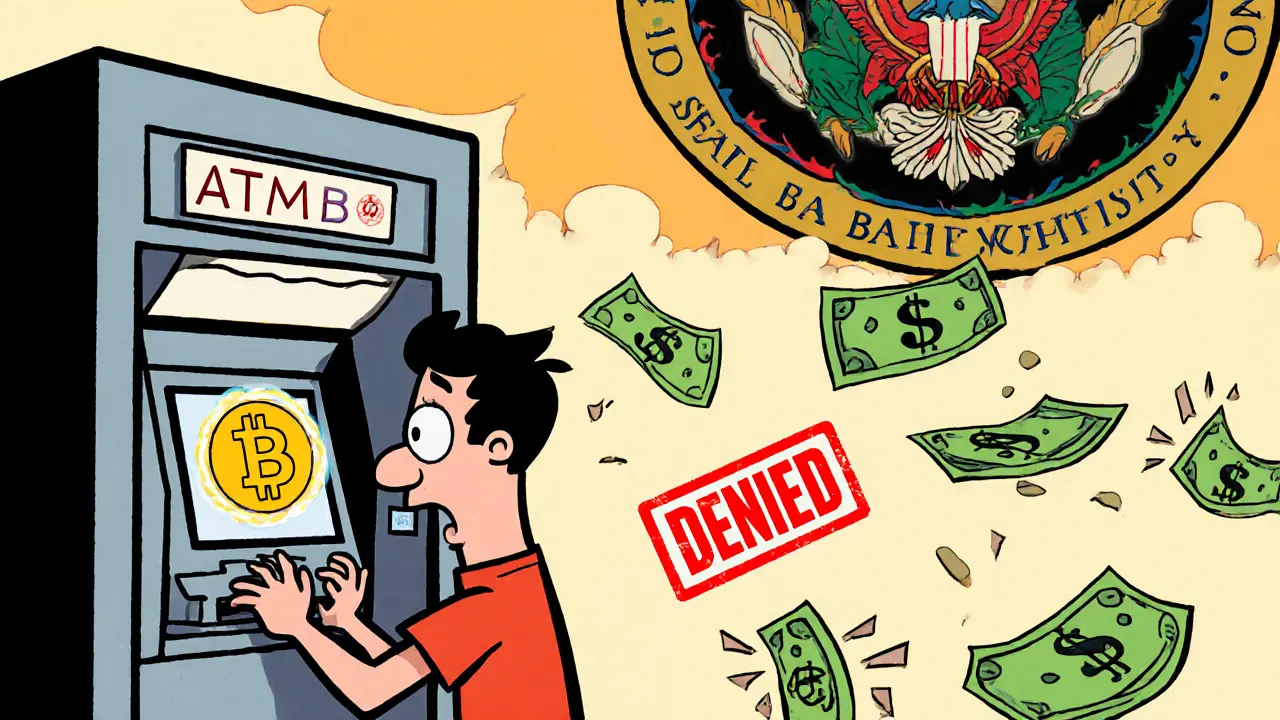

Ecuador bans banks from processing crypto transactions to protect its dollarized economy. Users rely on peer-to-peer trading and stablecoins, but face account freezes, high fees, and no legal protections. The ban remains strict despite growing demand and a proposed licensing bill.

View More