Crypto Exchange Restrictions: What’s Banned, Why, and Where You Can Still Trade

When you hear crypto exchange restrictions, rules imposed by governments or financial authorities that limit how, where, or if people can trade cryptocurrencies. Also known as crypto regulations, these rules are reshaping who can trade, what coins are allowed, and whether your wallet stays accessible. It’s not about stopping crypto—it’s about control. Countries are forcing exchanges to know who you are, block certain coins, and report every move you make. If you’ve noticed fewer privacy coins on Binance or can’t trade stablecoins in Vietnam, that’s not a glitch—it’s policy.

These restrictions don’t come out of nowhere. They’re tied to KYC crypto, the requirement for exchanges to verify your identity before letting you trade. Also known as crypto identity verification, this is now standard almost everywhere. In 2025, if you’re not verified, you’re locked out. That’s not just for big platforms like Coinbase—it’s for every small DEX that wants to stay legal. Behind KYC is crypto regulation, the growing web of laws forcing exchanges to follow anti-money laundering and tax reporting rules. Also known as AML crypto, this has led to the privacy coin delisting wave. Monero, Zcash, and others are being pulled from exchanges because regulators say they’re too hard to trace. That’s not a technical issue—it’s a legal one.

Some places go further. Vietnam’s crypto regulation, a framework requiring exchanges to hold $379 million in capital and banning all stablecoins. Also known as Directive 05/CT-TTg, it’s one of the strictest in Asia. Turkey banned crypto payments entirely. Nepal makes trading punishable by jail. And in the U.S., the Investment and Securities Act 2025, a new federal law that classifies crypto assets into clear categories. Also known as CLARITY Act, it finally gave institutions the green light to enter the market—by locking down everything else.

These rules aren’t just about stopping crime. They’re about control. If you want to trade, you must play by their rules. No more anonymous swaps. No more unregulated platforms. No more fake airdrops pretending to be real. That’s why you’ll find posts here about LocalTrade being a scam, Decoin having no team, and LEOS airdrops being fake. They’re not just bad projects—they’re the kind of things regulators are trying to wipe out. And that’s why even legit platforms are cutting corners: they’re scared of fines, jail, or losing their licenses.

But here’s the truth: restrictions don’t kill crypto. They just move it. People still trade in Vietnam using peer-to-peer apps. They still mine Spacemesh using old hard drives. They still use Wrapped Bitcoin to sneak assets into DeFi. The platforms that survive are the ones that adapt—KYC, compliance, transparency. The ones that don’t? They vanish overnight. What follows are real stories from the frontlines: exchanges that got shut down, coins that got banned, and users who learned the hard way what happens when you ignore the rules. You’re not here to guess—you’re here to know what’s real, what’s risky, and where you still have room to move.

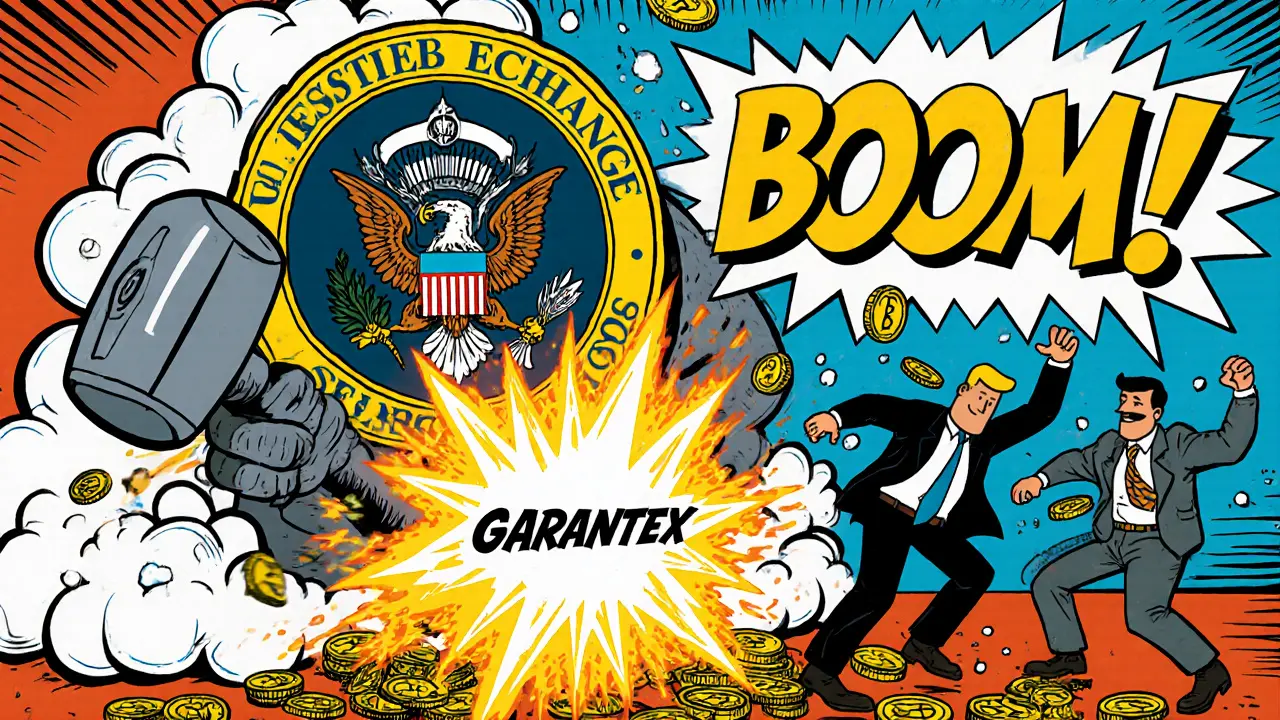

U.S. sanctions have shut down major Russian crypto exchanges like Garantex and Grinex, targeting their leaders, infrastructure, and even new stablecoins like A7A5. Users face frozen funds and shrinking access to crypto services.

View More