Crypto Compliance: What It Means and Why It’s Changing Crypto Forever

When you hear crypto compliance, the set of rules crypto platforms must follow to prevent fraud, money laundering, and illegal activity. Also known as crypto regulation, it’s no longer optional—it’s the foundation every exchange, wallet, and DeFi project now builds on. If you’ve ever been asked for a photo of your ID to trade crypto, you’ve already run into crypto compliance. It’s not a glitch. It’s the new normal.

Behind every KYC crypto exchanges, platforms that require users to verify their identity before trading is a legal requirement. In 2025, most countries demand this. The U.S. under the Investment and Securities Act 2025, the first federal law to classify crypto assets into clear categories, made it law. Vietnam’s Directive 05/CT-TTg, a rule forcing exchanges to hold $379 million in capital and ban stablecoins, shows how extreme it can get. Even countries that once ignored crypto, like Nepal, now ban it outright under old laws. Compliance isn’t just about stopping criminals—it’s about letting legitimate users trade without fear of shutdowns or frozen funds.

And it’s not just about ID checks. suspicious activity report, a formal alert exchanges file when they spot unusual crypto flows is now standard. If someone sends you $50,000 in crypto from a known mixer, your exchange will flag it. That’s not paranoia—it’s the AML crypto, anti-money laundering systems that track funds across blockchains working. Privacy coins like Monero and Zcash are getting delisted because they make these reports impossible. That’s why exchanges are choosing transparency over anonymity. It’s not about trust—it’s about survival.

What you’ll find below isn’t a list of news articles. It’s a real-world look at how crypto compliance is shaping what you can and can’t do. From scams hiding behind fake KYC pages to exchanges getting shut down for skipping regulations, these posts show you where the line is—and how to stay on the right side of it. You’ll see why some platforms vanish overnight, why some tokens have zero supply, and how governments are forcing change whether users like it or not. This isn’t theory. It’s what’s happening today.

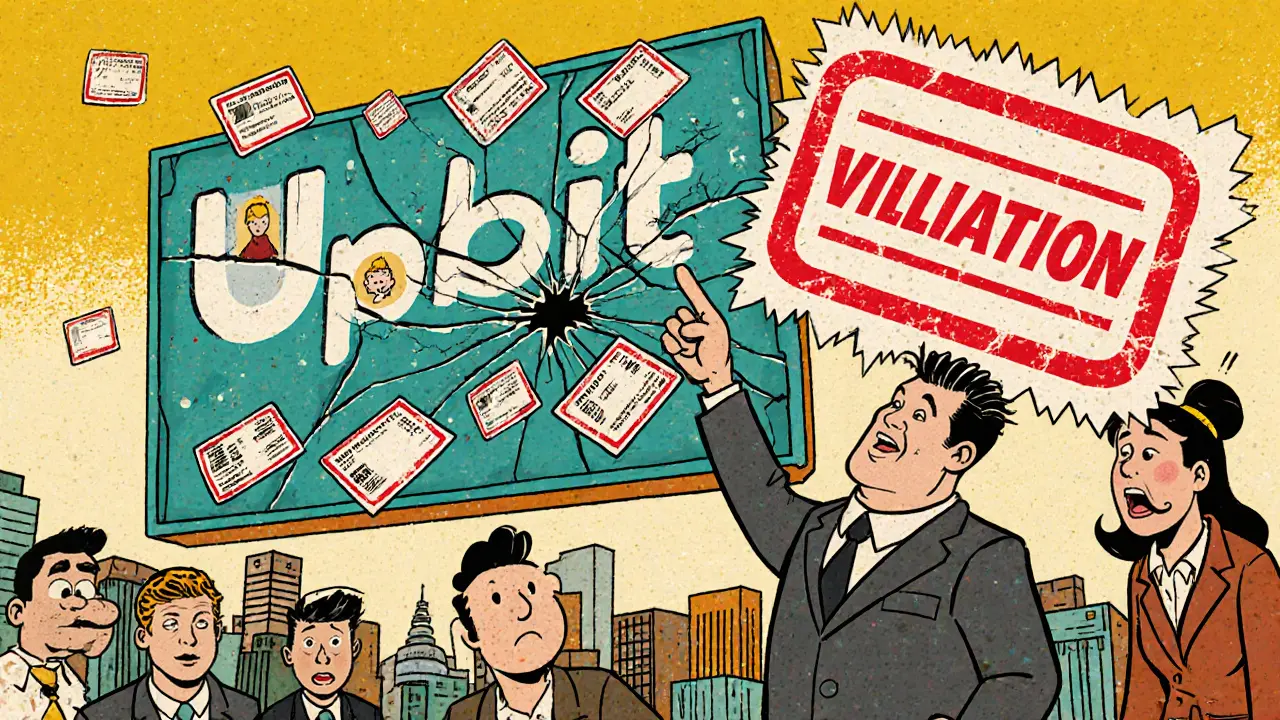

Upbit faced over 500,000 KYC violations, exposing systemic failures in identity verification. South Korea’s regulators responded with a suspension of new sign-ups and a major compliance overhaul, setting a global precedent for crypto enforcement.

View More