Crypto Capital Requirement: What You Need to Know About Regulatory Costs and Compliance

When you hear crypto capital requirement, the minimum amount of money a crypto exchange or business must hold to legally operate under government rules. Also known as financial reserve mandates, it’s not just bureaucracy—it’s your safety net. If a platform can’t prove it has enough cash on hand, it shouldn’t be touching your funds. And in 2025, that’s no longer optional.

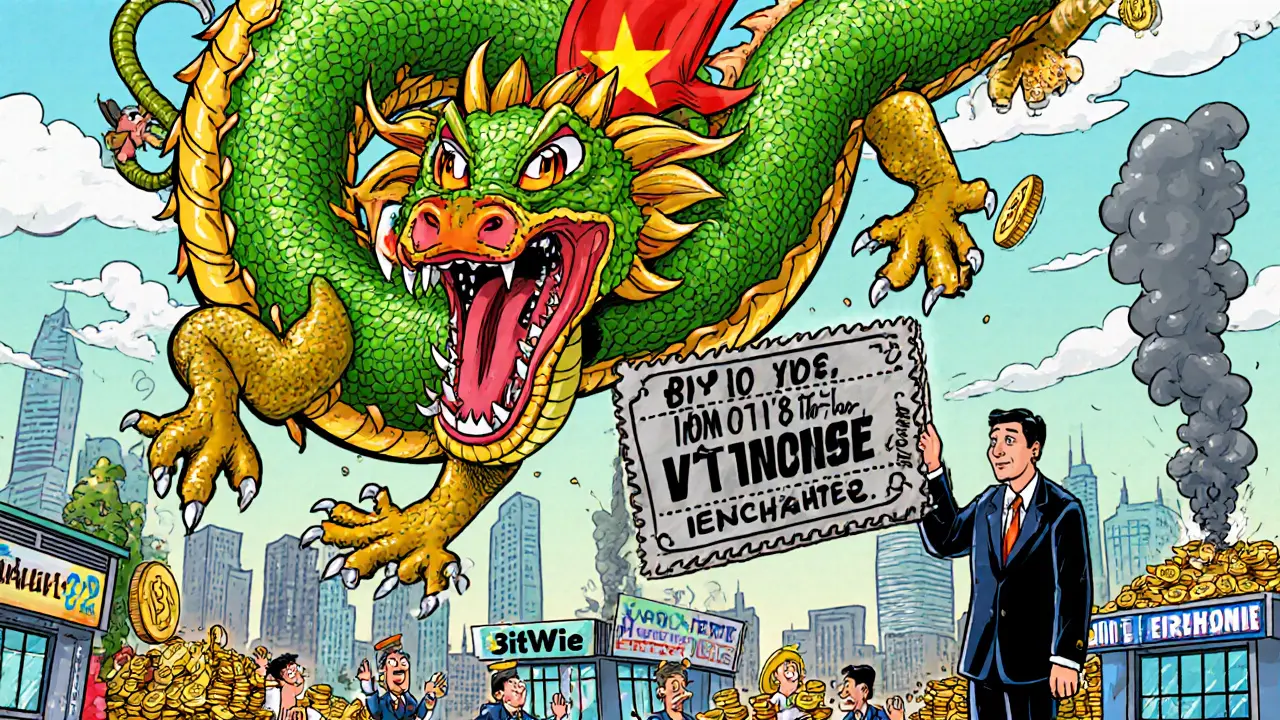

This isn’t about big banks playing hardball. It’s about stopping scams before they happen. Look at Vietnam’s new rules: exchanges need $379 million in capital just to apply for a license. No one’s done it yet. Why? Because most platforms are shell companies with fake volume and no real money. That’s the same problem behind LocalTrade, an unregulated exchange linked to scam recovery schemes and Decoin, a platform with no team, no audits, and zero transparency. These aren’t outliers—they’re the norm in unregulated spaces. The capital requirement exists to force real money, real accountability, and real consequences.

It’s not just about exchanges. KYC crypto exchanges, platforms that verify your identity to prevent fraud and money laundering are now standard because regulators know anonymity enables crime. The AML crypto, anti-money laundering rules that track suspicious crypto flows are tightening globally. Turkey banned crypto payments and forced exchanges to get multi-million-dollar licenses. The U.S. just passed the Investment and Securities Act 2025, the first clear federal framework classifying crypto assets. These aren’t random laws—they’re a coordinated push to separate the real players from the fraudsters.

What does this mean for you? If a platform doesn’t talk about its capital reserves, avoid it. If it claims to be "unregulated" like LocalTrade or Decoin, that’s a red flag, not a feature. The safest exchanges today are the ones that publish their compliance status, show they’re licensed, and prove they can cover losses. The capital requirement isn’t slowing crypto down—it’s cleaning it up. And the posts below show exactly how these rules are playing out: from Vietnam’s frozen market to Turkey’s crackdown, from KYC nightmares to the rise of regulated DeFi. You’ll see which projects survived the purge—and which vanished overnight.

Vietnam's new crypto framework, Directive 05/CT-TTg, requires exchanges to hold $379 million in capital and bans fiat-backed stablecoins. It's the strictest rule in Southeast Asia-and it's forcing a massive industry shakeup.

View More