Blockchain Fees Explained: What You Pay and Why It Matters

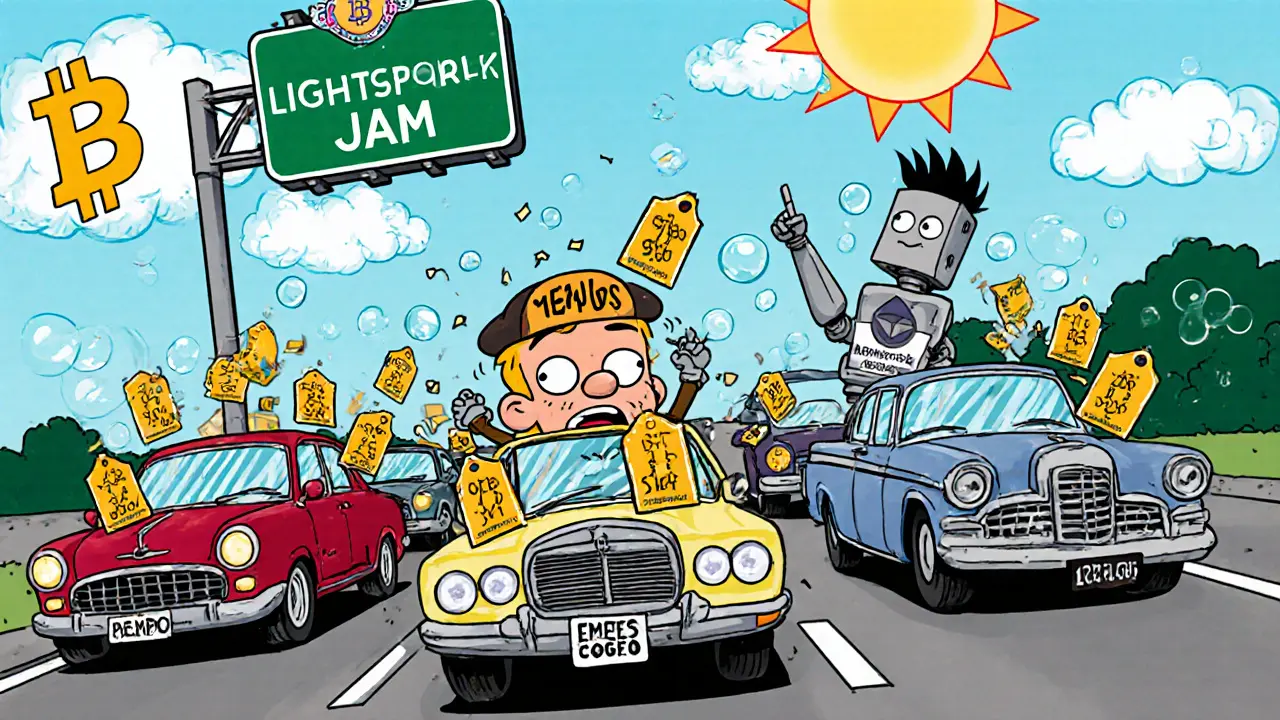

When you send crypto, swap tokens, or stake on a blockchain fees, the cost users pay to get their transactions processed on a decentralized network. Also known as gas fees, these charges keep networks running by rewarding miners or validators for securing the system. Without them, your transaction would sit in limbo—or worse, get stolen by bots. These fees aren’t random. They’re driven by demand, network congestion, and how busy the chain is at that exact moment.

On Ethereum, fees spike when NFT drops happen or DeFi protocols get flooded. On cheaper chains like Base or Meter, you might pay pennies. But here’s the catch: low fees don’t always mean better. VoltSwap runs on Meter with low fees and front-running protection, but its tiny volume means slippage can still hurt you. Meanwhile, exchanges like LocalTrade and Decoin hide behind fake volume and zero transparency—so even if their fees look low, you’re risking your funds. Blockchain fees aren’t just about cost—they’re a signal. High fees on a trusted chain like Bitcoin or Ethereum mean security and finality. Low fees on an unknown DEX? That’s often a red flag for rug pulls or fake activity.

It’s not just about the number. It’s about what’s behind it. decentralized exchange, a platform that lets users trade crypto directly from their wallets without a middleman. Also known as DEX, these platforms rely on blockchain fees to function. But not all DEXs are built the same. Some, like Alien Base on Base chain, use low-fee infrastructure to attract memecoin traders. Others, like those using zk-STARKs or zk-SNARKs, bundle fees into privacy layers that slow things down but protect your trades. And then there are chains like Spacemesh, which don’t use traditional fees at all—they reward you with unused hard drive space instead of electricity. That’s a whole different model. Meanwhile, crypto transaction fees, the specific amount paid per transfer or smart contract interaction on a blockchain. Also known as network costs, these vary wildly. On some days, sending ETH costs $5. On others, it’s $50. Why? Because every time someone mints an NFT or launches a new token, the network gets crowded. The same thing happens with crypto network costs on Polygon, Solana, or Avalanche. You can’t control the fee, but you can control when you act. Wait for quiet hours. Use layer-2s. Or switch chains entirely.

What you’ll find in the posts below isn’t just a list of platforms. It’s a map of where fees are fair, where they’re hidden, and where they’re outright scams. You’ll see how Metahero’s airdrop claims don’t match their fee structure, why AdEx’s old airdrop mattered for tokenomics, and how Turkey’s crypto rules forced exchanges to raise fees to meet licensing costs. You’ll learn why wrapping ETH into wETH adds hidden fees, and how privacy coin delistings changed fee dynamics across major exchanges. This isn’t theory. It’s what’s happening right now. And if you’re trading crypto, you need to know it.

Learn how transaction fee estimation tools help you pay the right amount for Bitcoin and Ethereum transactions-no more overpaying or waiting hours for confirmations. Get the best tools and tips for 2025.

View More