Bitcoin UAE: What You Need to Know About Bitcoin in the United Arab Emirates

When people talk about Bitcoin UAE, the growing adoption and unique regulatory environment of Bitcoin in the United Arab Emirates. Also known as Bitcoin in the Gulf, it’s not just about buying crypto—it’s about navigating one of the most strategic, cash-rich, and tightly controlled crypto markets in the Middle East. Unlike countries that ban crypto outright, the UAE has taken a careful, business-first approach. It’s not a free-for-all, but it’s far from a shutdown. You can buy Bitcoin with dirhams, store it in local wallets, and even trade it on licensed exchanges like Binance UAE and Bybit’s Dubai office. But here’s the catch: you’ll need to jump through KYC hoops, and your bank might freeze your account if they think you’re moving too much money too fast.

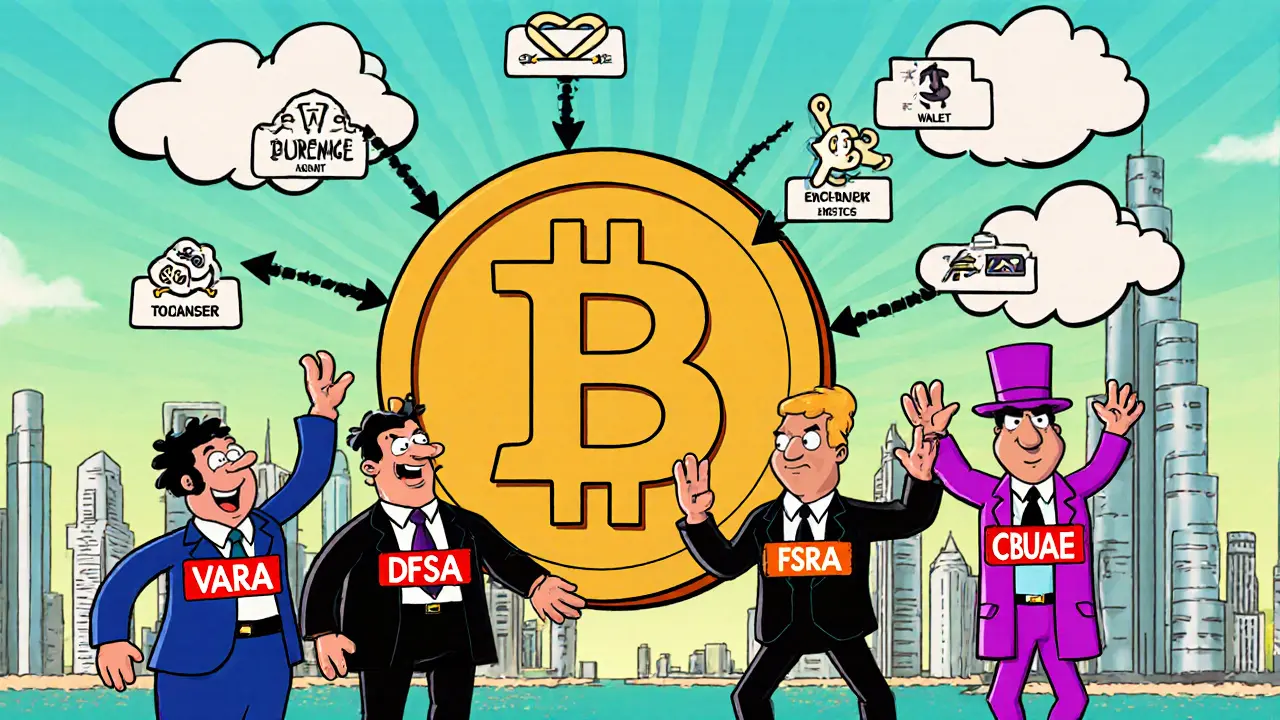

The crypto regulation UAE, the framework that governs how digital assets are handled in the UAE, including licensing, taxation, and anti-money laundering rules is shaped by the Virtual Assets Regulatory Authority (VARA) and the Central Bank of the UAE. These bodies don’t just watch—they enforce. Exchanges need multi-million-dollar licenses. Stablecoins are restricted. And if you’re a business, you’re expected to report every transaction. For regular users, this means less anonymity but more protection. No more shady platforms like LocalTrade or Decoin slipping through the cracks. The UAE wants legit players, and that’s good news if you’re trying to keep your Bitcoin safe.

Then there’s the Bitcoin trading UAE, the real-world activity of buying, selling, and holding Bitcoin within the UAE’s financial ecosystem. It’s not just traders on laptops. You’ve got expats using Bitcoin to send money home, freelancers getting paid in BTC to avoid currency conversion fees, and even some small shops accepting it for coffee or electronics. But don’t assume it’s easy. The local banks don’t love crypto. Many still treat Bitcoin users like high-risk clients. That’s why many people turn to peer-to-peer platforms or non-KYC wallets—but those come with their own dangers. You can’t just trust any app. If it doesn’t mention VARA or has no clear team, it’s probably a scam. Look at what happened with fake airdrops like LEOS or BABYDB. The same tactics show up in Dubai Telegram groups.

And let’s not forget Bitcoin wallet UAE, the tools and methods used by residents to securely store their Bitcoin within the UAE’s legal and technical landscape. Hardware wallets like Ledger or Trezor are common among serious holders. Software wallets like Trust Wallet and Exodus get used too, especially by newcomers. But if you’re using a wallet tied to a local exchange, remember: you don’t own the keys. And if that exchange gets shut down or hacked, you’re out of luck. The UAE doesn’t insure your crypto like it does bank deposits. So if you’re holding more than a few hundred dollars, you need to take control yourself.

What you’ll find below isn’t just a list of articles—it’s a real-world guide to how Bitcoin works in the UAE right now. You’ll see what’s legal, what’s risky, and what’s outright fake. You’ll learn how regulations like those in Vietnam or Switzerland compare, why privacy coins are vanishing from local exchanges, and how tax rules might hit you if you’re holding long-term. No fluff. No hype. Just what matters if you’re living in or trading from the UAE.

The UAE offers one of the world’s clearest crypto frameworks for Bitcoin and altcoins. Learn how licensing, tax rules, and regulations work in 2025-and why businesses are moving here in droves.

View More