Bitcoin Fee Estimator: How to Save Money on Transactions

When you send Bitcoin, a decentralized digital currency that operates on a peer-to-peer network without a central authority. Also known as BTC, it relies on miners to confirm transactions and secure the network. But every time you send Bitcoin, you pay a fee—and that fee isn’t fixed. It changes based on how busy the network is. That’s where a Bitcoin fee estimator, a tool that predicts the optimal fee needed to get your transaction confirmed in a specific time window comes in. Without one, you could end up paying way more than you need—or waiting hours for your transaction to go through.

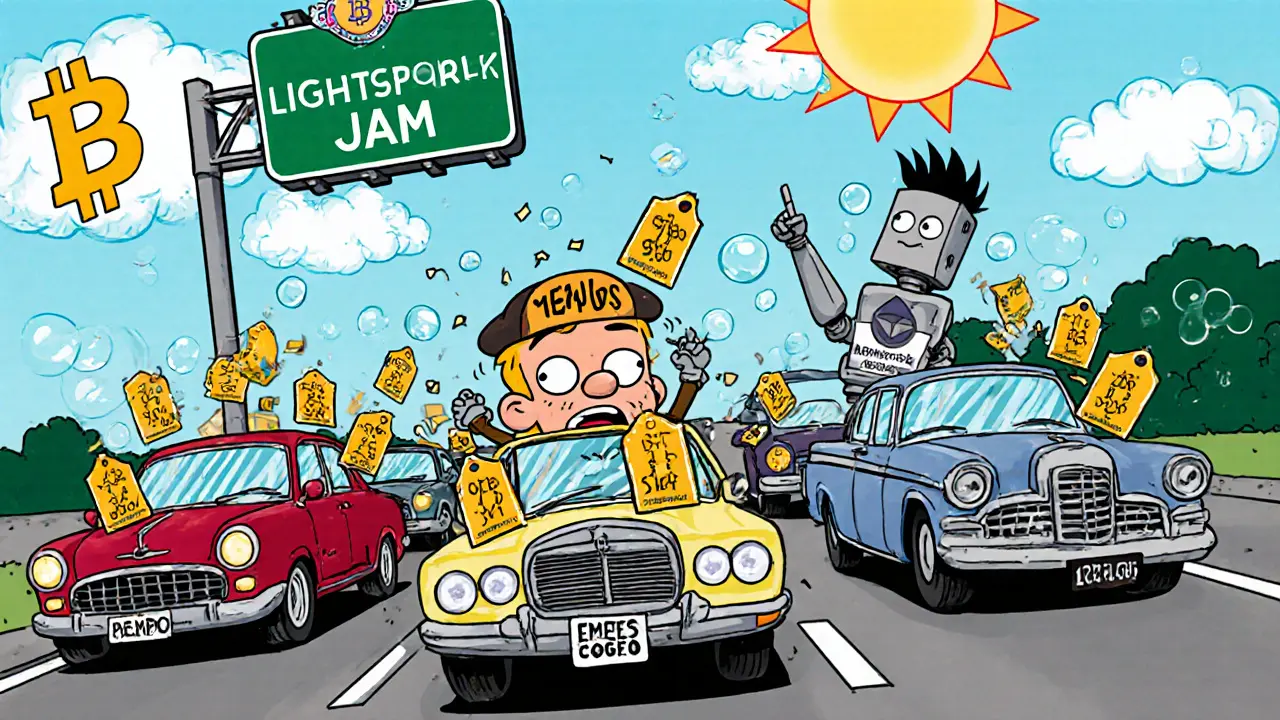

Fee estimators work by looking at the mempool, the waiting room where unconfirmed Bitcoin transactions sit before miners pick them up. If the mempool is packed, fees go up because people are bidding to get their transactions processed faster. If it’s empty, fees drop. Some estimators even show you how long your transaction might take at different fee levels: 10 minutes, 1 hour, or 24 hours. You don’t need to be a tech expert to use them. Wallets like Electrum, BlueWallet, and even Coinbase have built-in estimators that show you real-time options. The goal? Pay just enough to get your transaction confirmed without throwing money away.

Why does this matter? Because Bitcoin fees can swing from under $0.10 to over $50 in a single day. During the 2021 crypto boom, some users paid $60 just to send $100 worth of Bitcoin. That’s not a glitch—that’s how the system works when demand spikes. A good fee estimator helps you avoid those spikes. It also helps you plan. If you know a major event is coming—like a token launch or a network upgrade—you can send your Bitcoin ahead of time at a low fee instead of rushing in last minute and overpaying.

There’s a big difference between paying a fee and wasting money. Many people think higher fees mean faster confirmation, but that’s not always true. If you set your fee too high, you’re just giving miners extra cash. If you set it too low, your transaction might sit for days. The sweet spot is understanding the current network conditions and matching your fee to your urgency. Tools like BitInfoCharts, Mempool.space, and Bitcoinfees.earn.com give you live data on fee rates, transaction volume, and estimated confirmation times. You don’t need to guess. You can see exactly what’s happening.

And it’s not just about saving dollars. High fees make small Bitcoin transactions impractical. If you’re trying to send $5 to a friend, paying $3 in fees doesn’t make sense. That’s why fee estimation isn’t just a technical detail—it’s a usability issue. The future of Bitcoin as everyday money depends on keeping fees low and predictable. That’s why understanding how fee estimators work is as important as knowing how to buy or store Bitcoin.

Below, you’ll find real-world reviews and breakdowns of platforms and tokens that deal with transaction efficiency, network congestion, and cost-saving strategies. Some cover sidechains like Liquid Network that reduce Bitcoin fees. Others expose scams that pretend to offer "zero fee" Bitcoin transfers. You’ll see how projects like Flux and VoltSwap optimize for low-cost operations. And you’ll learn why some exchanges charge hidden fees that aren’t obvious until you’re already in the transaction. This isn’t theory. It’s what’s happening right now on the network—and how to protect your money from unnecessary costs.

Learn how transaction fee estimation tools help you pay the right amount for Bitcoin and Ethereum transactions-no more overpaying or waiting hours for confirmations. Get the best tools and tips for 2025.

View More