Banking Crypto Restrictions: What’s Banned, Why, and How It Affects You

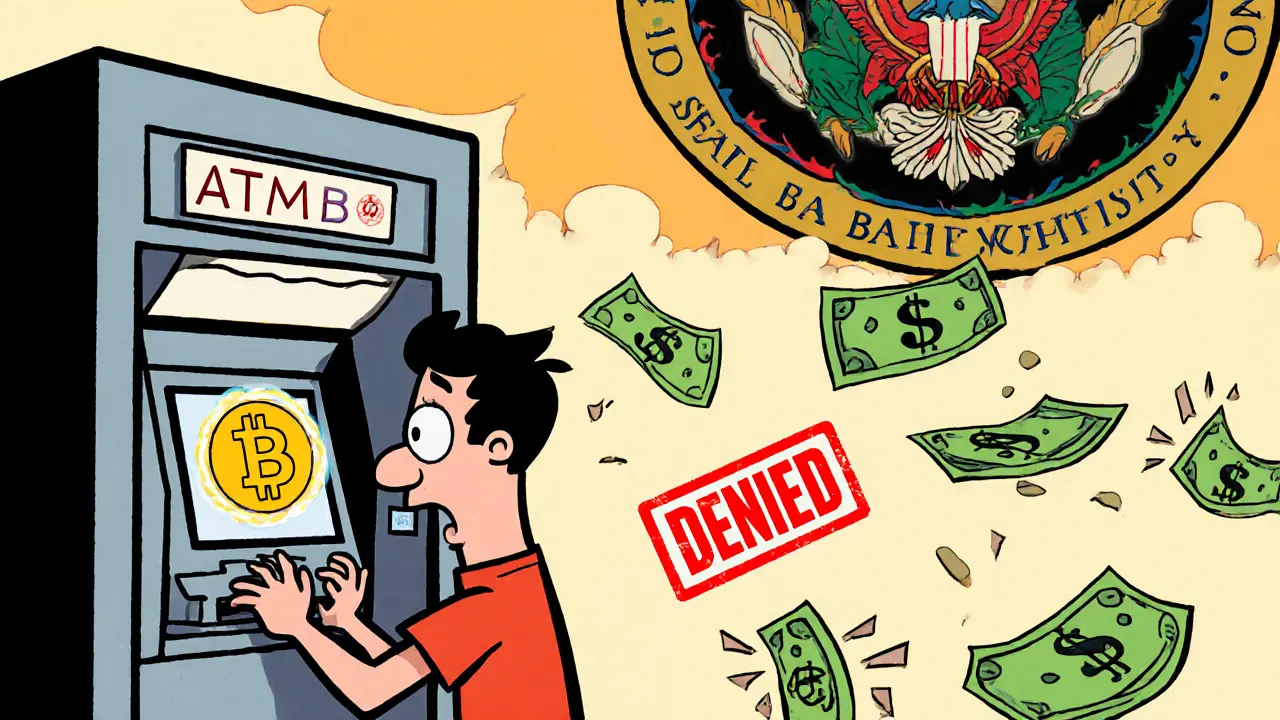

When you try to move money between your bank and a crypto exchange, and it gets blocked, you’re feeling the weight of banking crypto restrictions, policies enforced by traditional financial institutions to limit or block transactions involving digital assets. Also known as crypto banking bans, these rules aren’t random—they’re driven by global anti-money laundering laws, fears over volatility, and pressure from regulators like the FATF and FinCEN. It’s not just about whether you can buy Bitcoin—it’s about whether your bank will let you even send the dollars to do it.

These restrictions show up in different ways. In places like Vietnam, a country that legalized crypto in 2025 but imposed extreme controls, including $379 million capital requirements for exchanges and a ban on stablecoins, banks refuse to process any crypto-related transfers unless they’re through one of five licensed platforms—and even then, only in Vietnamese dong. In Turkey, a nation that banned crypto payments outright while forcing exchanges to get multi-million-dollar licenses, your bank might flag any transaction to Binance or KuCoin as suspicious. Even in the U.S., banks are quietly shutting down accounts tied to crypto businesses, citing compliance risks. This isn’t just about bad actors—it’s about banks playing it safe, often at the cost of legitimate users.

What’s worse? These restrictions often hit privacy coins hardest. Monero and Zcash have been quietly delisted from major exchanges because banks won’t clear transactions involving them. That’s why crypto regulation, the growing web of laws and compliance demands forcing exchanges to collect KYC data and report suspicious activity is now the biggest barrier to entry—not technical complexity, not price swings, but whether your bank will let you participate at all. You can’t trade what you can’t fund, and you can’t fund what your bank won’t touch.

Meanwhile, countries like Nepal are still enforcing outright bans under old laws from the 1960s, with jail time for trading crypto. And in Switzerland, while you can hold crypto without paying capital gains tax, your bank might still refuse to open an account for you if you’re a crypto trader. It’s a mess. The system isn’t designed for decentralized money. It’s built for control, traceability, and intermediaries—and crypto breaks all of that.

What you’ll find below are real stories from people who ran into these walls. From platforms shut down for lacking compliance, to airdrops that vanished because banks froze the wallets, to exchanges that disappeared overnight after regulators pressured their banking partners. These aren’t hypothetical risks. They’re daily realities. Some of the projects listed here failed because they couldn’t get banking access. Others survived by avoiding banks entirely—using peer-to-peer platforms, crypto-only gateways, or cash-based methods. This collection isn’t about guessing what might happen. It’s about showing you what already did.

Ecuador bans banks from processing crypto transactions to protect its dollarized economy. Users rely on peer-to-peer trading and stablecoins, but face account freezes, high fees, and no legal protections. The ban remains strict despite growing demand and a proposed licensing bill.

View More