Altcoins UAE: What You Need to Know About Crypto Trading in the United Arab Emirates

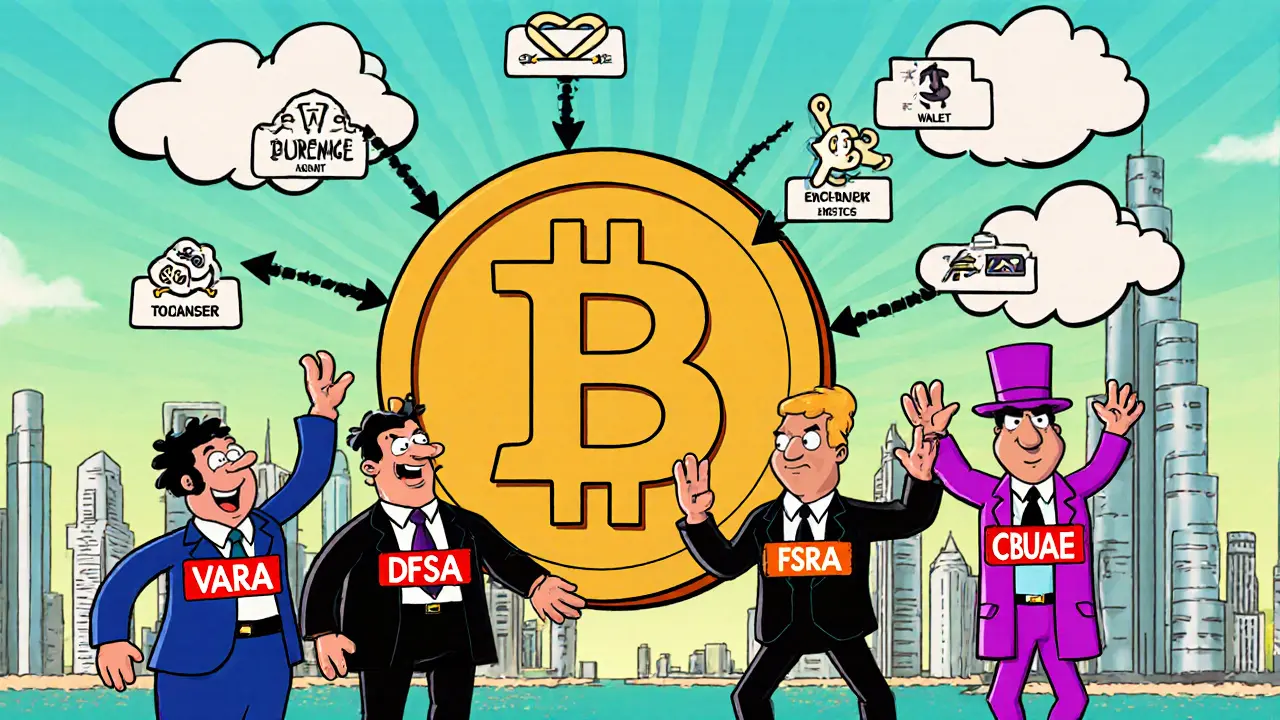

When it comes to altcoins UAE, cryptocurrencies beyond Bitcoin that are actively traded and held by residents of the United Arab Emirates. Also known as alternative coins, they’re the backbone of daily trading for thousands in Dubai and Abu Dhabi. Unlike countries that ban crypto, the UAE has built a clear, if strict, legal path for digital assets. The Dubai Virtual Assets Regulatory Authority (VARA) and the Abu Dhabi Global Market (ADGM) are the two main bodies that license exchanges and set rules — and they’re not playing around.

That means if you’re buying crypto regulation UAE, the official rules and licensing requirements set by UAE authorities for cryptocurrency platforms and users, you’re dealing with one of the most transparent systems in the Middle East. Exchanges must hold real capital, prove they’re not laundering money, and report all transactions. This isn’t just paperwork — it’s why you won’t find sketchy platforms like LocalTrade or Decoin operating openly here. If a crypto exchange is legal in the UAE, it’s because it passed real scrutiny.

And the taxes? UAE crypto tax, the current tax treatment of cryptocurrency gains and holdings under United Arab Emirates federal law is simple: no capital gains tax, no income tax on crypto trades, and no wealth tax on holdings. That’s why so many traders from Europe and Asia are moving their operations here. But don’t get lazy — you still need to keep records. If you’re mining, staking, or earning tokens from airdrops, those are considered income and must be reported if you’re a resident business owner. For private individuals, though? You’re clear.

What about the exchanges? The big ones like Bybit, Binance (with local licensing), and OKX all have UAE offices. They support dirham deposits, offer local customer service, and comply with KYC rules that are tougher than in most Western countries. You’ll need your passport, proof of address, and sometimes a selfie holding your ID. It’s not fast, but it’s safe. And that’s the trade-off: less anonymity, more protection.

Altcoins in the UAE aren’t just for speculation. People here use them for remittances, DeFi lending, and even paying for services in some local shops. Projects like Flux and Spacemesh have small but active communities in Dubai. Airdrops from legitimate platforms like Metahero and AdEx Network get real attention — but so do fake ones. If someone’s promising free tokens with no effort, they’re not from the UAE. Real opportunities here come from verified platforms, not Telegram bots.

And if you’re wondering about privacy coins? They’re basically dead here. Monero and Zcash got delisted from UAE exchanges years ago because regulators said they couldn’t track them. That’s not a bug — it’s a feature. The UAE wants clean, traceable transactions. So if you’re looking for anonymity, you’re better off looking elsewhere.

What you’ll find below are real reviews, deep dives, and scam alerts from people who’ve actually traded altcoins in the UAE. No fluff. No hype. Just what works, what doesn’t, and what to avoid before you lose money. Whether you’re new to crypto or you’ve been holding for years, the rules here don’t change — but the opportunities do. Let’s see what’s actually happening on the ground.

The UAE offers one of the world’s clearest crypto frameworks for Bitcoin and altcoins. Learn how licensing, tax rules, and regulations work in 2025-and why businesses are moving here in droves.

View More