A7A5 Stablecoin: What It Is, Why It Matters, and What You Need to Know

When you hear A7A5 stablecoin, a digital currency designed to maintain a stable value, usually tied to a fiat currency like the US dollar. Also known as pegged token, it's meant to reduce the wild price swings common in crypto—so you can trade, lend, or hold without panic. But here’s the catch: A7A5 isn’t on any major exchange. No whitepaper. No team. No audit. And yet, it pops up in price trackers and shady forums. Why? Because in crypto, even ghosts can have a price.

Stablecoins like USDT, USDC, and DAI are the backbone of DeFi. They let you move money across chains without turning your portfolio into a rollercoaster. But A7A5? It doesn’t play by the same rules. It’s not backed by reserves you can verify. It’s not listed on Coinbase, Kraken, or even smaller DEXs like Uniswap. You won’t find it in any official wallet. That makes it different from real stablecoins—it’s more like a mirage. And mirages don’t pay bills. They just make you chase something that isn’t there.

What’s even stranger is that A7A5 shows up in posts alongside real projects like AlphBanX (ABX), a lending token on Alephium that issues ABD, a real stablecoin backed by collateral, and Margaritis (MARGA), a token with zero supply that’s dead on arrival. These posts don’t just list A7A5—they question it. They compare it to scams, dead coins, and fake airdrops. That’s not an accident. The pattern is clear: A7A5 is a red flag wrapped in a ticker symbol. It’s not a tool. It’s a test. Are you going to check the facts—or just trust a price chart?

That’s why this collection matters. You won’t find a guide on how to buy A7A5. You won’t find a tutorial on staking it. What you will find are deep dives into projects that actually work—like VoltSwap’s front-running resistance, Flux’s decentralized cloud mining, and how zk-STARKs keep transactions private. You’ll see how real stablecoins like ABX function, how airdrops actually deliver value, and how scams like MARGA and BABYDB vanish overnight. A7A5 is the ghost in the machine. These posts are the flashlights.

If you’re looking for a stablecoin to use, stick with ones that have audits, liquidity, and teams you can Google. A7A5? It’s not a coin. It’s a warning. And the truth about it? It’s hiding in plain sight—in the posts below.

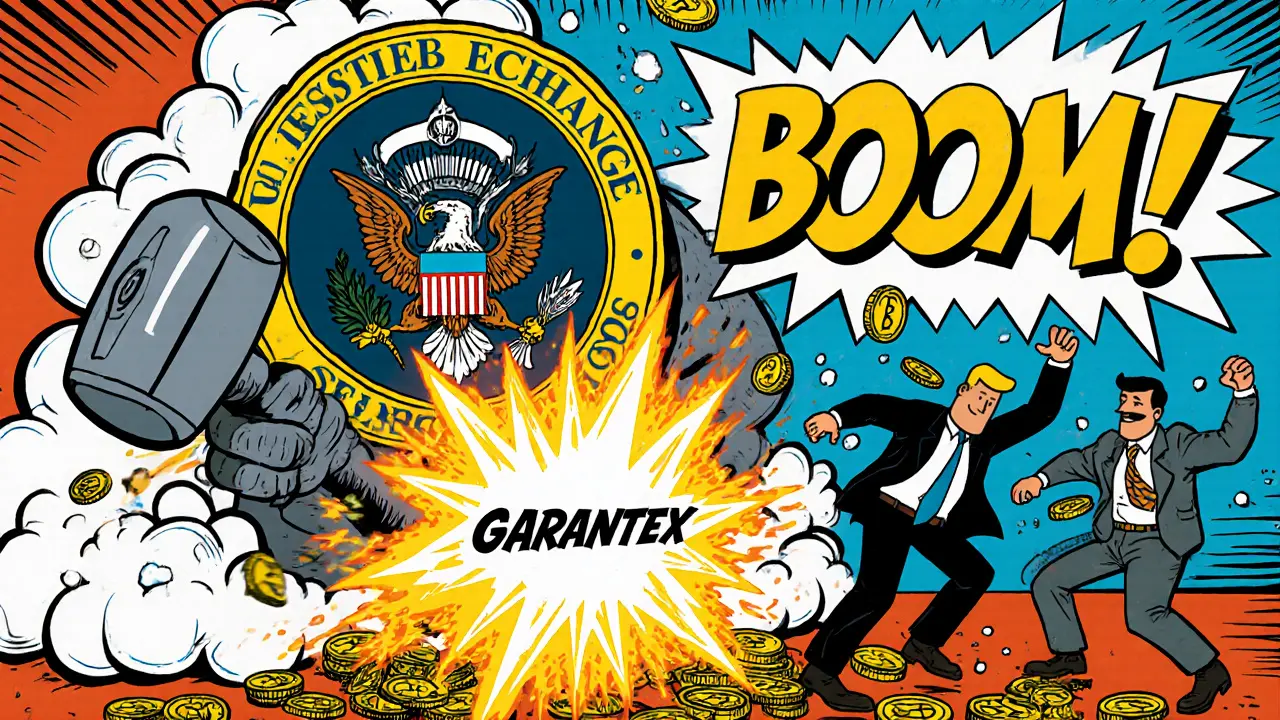

U.S. sanctions have shut down major Russian crypto exchanges like Garantex and Grinex, targeting their leaders, infrastructure, and even new stablecoins like A7A5. Users face frozen funds and shrinking access to crypto services.

View More